Growth equity for the future of food

Re:food is the transatlantic growth equity investor reshaping the food system. We partner with category changing companies who turn the world’s biggest challenge into outsized returns.

agrifood investing specialists

years

of agrifood investing

consecutive quarters

of value-creating growth

portfolio revenue growth with expanding margins

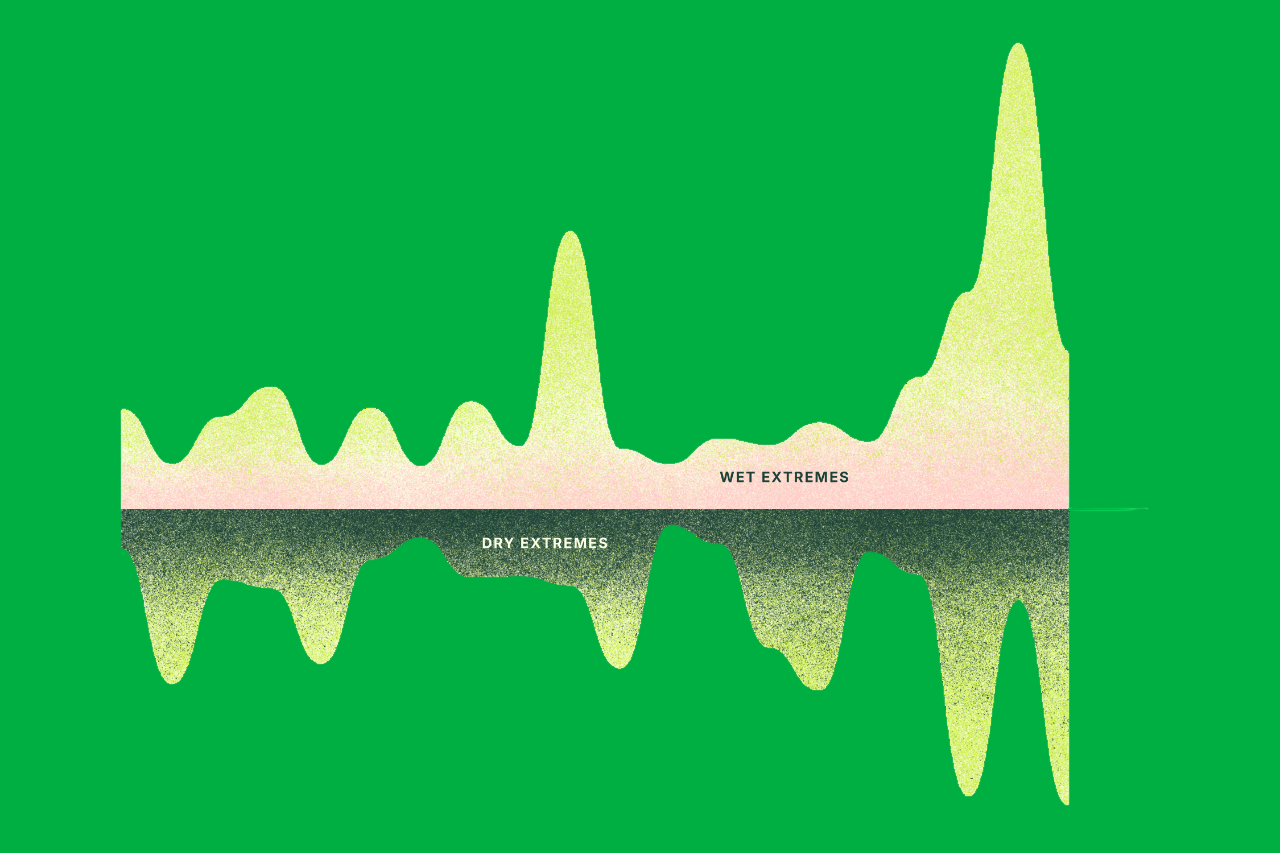

EAT-Lancet food-system shifts accelerated across the

portfolio.

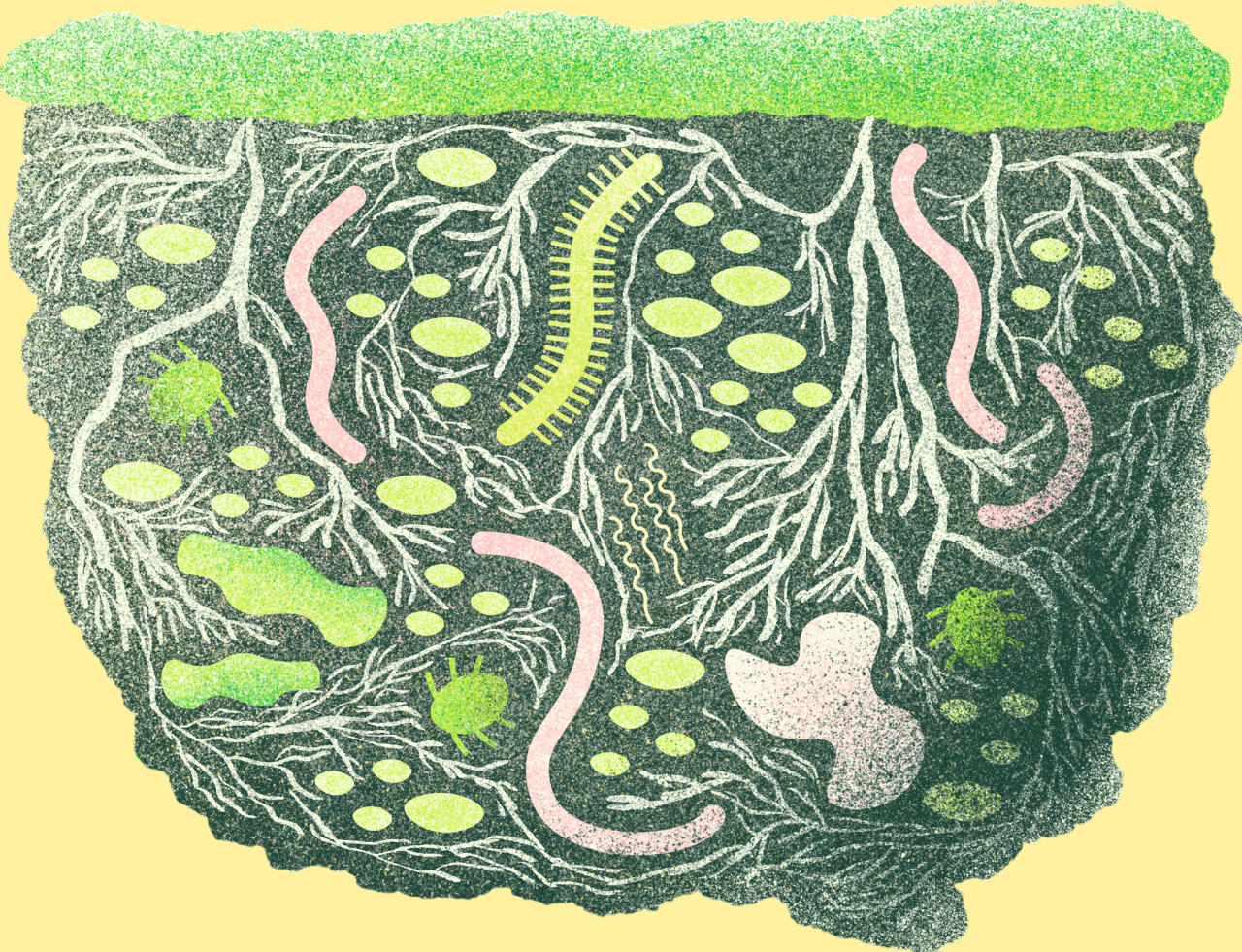

hectares with improved soil health through portfolio products

specialized conviction capital per partnership

We partner with category changing companies

Our Edge: Specialized Conviction Capital

As transatlantic specialists, we partner with growth-stage agrifood companies where we have a deep understanding of the technology, market, and business model; we invest with conviction when we can deliver long-term value creation; and we deploy strategic, aligned capital with expertise to achieve outsized returns and undeniable impact.

Value Creation

Financing, governance, strategy, and operational excellence to scale category changers.

- Long-Term Partnerships

Long-term value-based trust relationships across our ecosystem with a high-conviction, partnership-first mindset.

Systems Change

Guided by the Re:food Solvable Framework, aligned with world-leading research, turning planetary science into actionable investment themes that win.

Stay updated with our latest news